Buying gold or silver offers unique financial security, as these precious metals maintain their value over time, proving to be safe havens in times of economic crisis or currency fluctuation.

Their independence from traditional financial markets makes them effective portfolio diversification tools, reducing overall risk and offering protection against inflation. Investing in gold and silver, whether in coin or bullion form, also means owning tangible assets that are easily exchangeable and recognized worldwide.

What's more, these metals offer aesthetic and historical appeal for collectors, enriching their value beyond the financial investment.

Investing in gold and silver can take many forms, offering investors flexibility according to their objectives and strategy.

Coins and bullion represent the most tangible option, providing physical possession of the precious metal, with coins such as the Krugerrand or Maple Leaf being particularly popular.

Exchange-traded funds (ETFs) and shares in mining companies offer exposure to precious metals without physical possession, suitable for investors preferring easier integration into their traditional portfolios.

Certificates and metal accounts also allow investors to invest in gold and silver, offering security and convenience without the challenges of physical storage.

Each of these options has its own advantages and considerations, tailored to different investor profiles and preferences.

To avoid the tax in the state of California, you must make a purchase of more than $1,500. This applies only to gold and silver, and only if you purchase from one dealer.

You can now buy physical gold on our site in the form of gold or silver bars or coins.

Physical gold is a safe haven in times of crisis and represents a must in an asset portfolio.

Gold Bars

Gold Bars

Rare Gold Coins

Rare Gold Coins

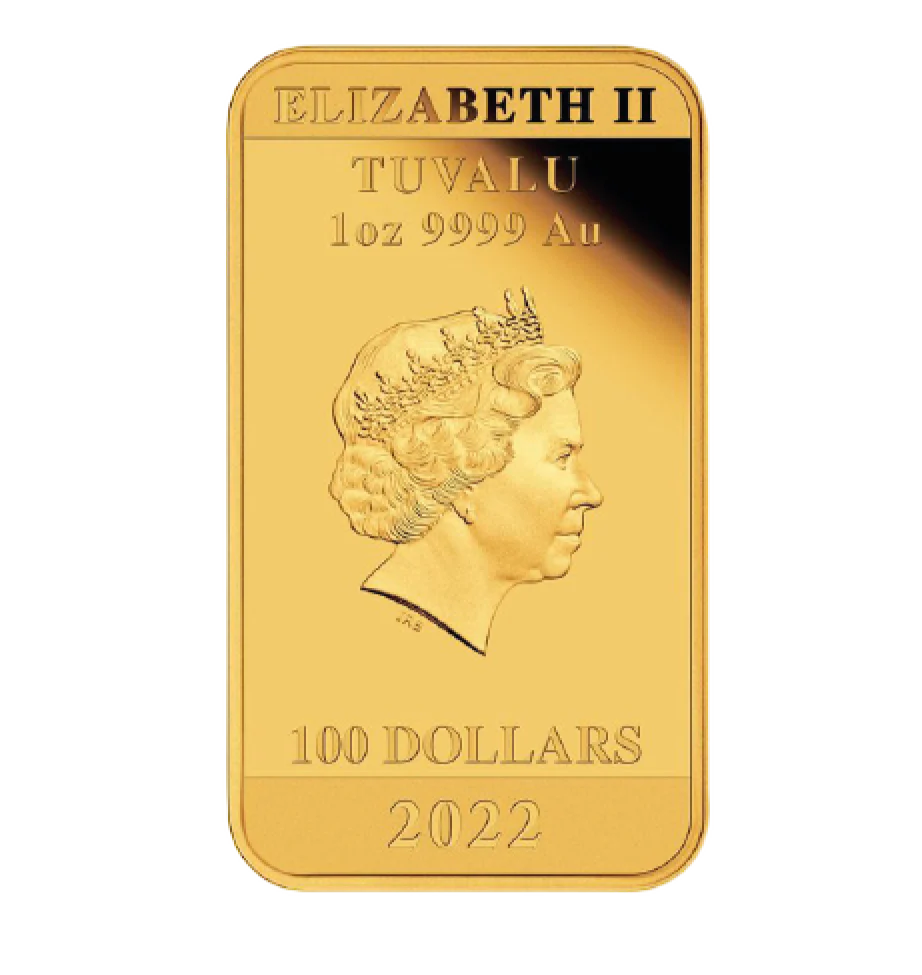

Modern Gold Coins

Modern Gold Coins

Best Sellers

Best Sellers

French silver coins

French silver coins